The monthly returns are then compounded to arrive at the annual return. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

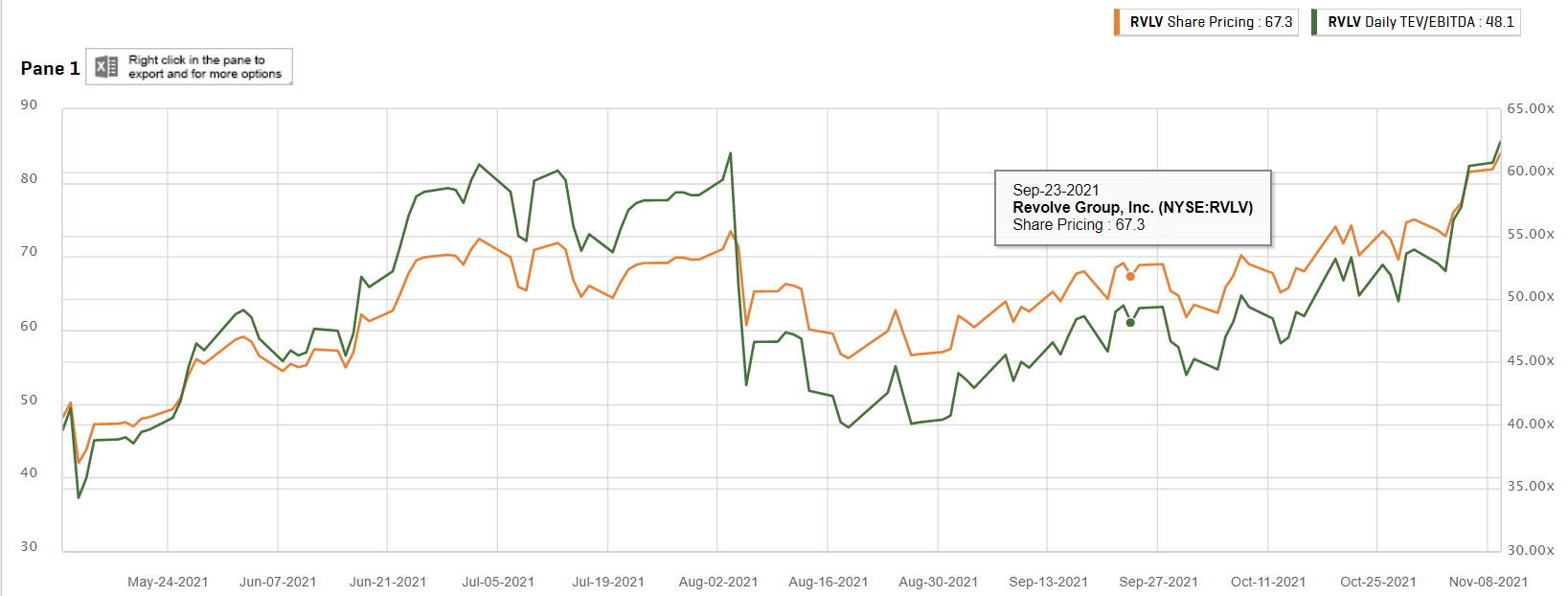

REVOLVE STOCK PRICE PLUS

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. These returns cover a period from Januthrough May 15, 2023. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.17% per year.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. and Morningstar, Inc.Ĭopyright 2023 Zacks Investment Research | 10 S Riverside Plaza Suite #1600 | Chicago, IL 60606Īt the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Forbes Media, LLC Investor's Business Daily, Inc. Each of the company logos represented herein are trademarks of Microsoft Corporation Dow Jones & Company Nasdaq, Inc. This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. The stock currently has a Zacks Rank #4 (Sell), indicating that it could underperform the broader market in the near term. Shares of Revolve Group have returned -23.5% over the past month versus the Zacks S&P 500 composite's +0.4% change. View all Key Company Metrics for Revolve Group here> Gross profit- REVOLVE: $120.24 million versus the four-analyst average estimate of $125.06 million.Gross profit- FWRD: $18.98 million versus the four-analyst average estimate of $18.26 million.The reported number represents a year-over-year change of -2.6%. Net sales- REVOLVE: $231.65 million versus the five-analyst average estimate of $244.55 million.Compared to the year-ago quarter, this number represents a +4.8% change. Net sales- FWRD: $47.96 million versus $46.09 million estimated by five analysts on average.The reported number represents a change of +15.9% year over year. Geographic net sales- Rest of the world: $52.89 million compared to the $43.40 million average estimate based on three analysts.The reported number represents a year-over-year change of -4.7%. Geographic Net sales- United States: $226.72 million versus the three-analyst average estimate of $247.33 million.Here is how Revolve Group performed in the just reported quarter in terms of the metrics most widely monitored and projected by Wall Street analysts: Since these metrics play a crucial role in driving the top- and bottom-line numbers, comparing them with the year-ago numbers and what analysts estimated about them helps investors better project a stock's price performance. While investors closely watch year-over-year changes in headline numbers - revenue and earnings - and how they compare to Wall Street expectations to determine their next course of action, some key metrics always provide a better insight into a company's underlying performance. The company delivered an EPS surprise of +26.67%, with the consensus EPS estimate being $0.15. The reported revenue compares to the Zacks Consensus Estimate of $290.29 million, representing a surprise of -3.68%. EPS came in at $0.19, compared to $0.30 in the year-ago quarter.

REVOLVE STOCK PRICE FREE

For the quarter ended March 2023, Revolve Group ( RVLV Quick Quote RVLV - Free Report) reported revenue of $279.61 million, down 1.4% over the same period last year.

0 kommentar(er)

0 kommentar(er)